Configure multiple tax types and tax rates

Summary

Tax types are created to apply taxes to taxable menu items. Each enabled tax type has a tax rate.

Example:

- Tax type = sales tax

- Tax rate = 8.75%

By default, each taxable menu item is automatically configured with a sales tax. Additional tax types can be configured for a site and applied to any menu item as needed, e.g., liquor tax, city tax, etc.

Each tax type is configured with a tax rate.

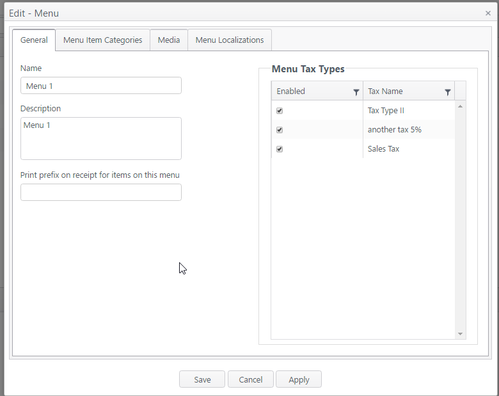

Configuration

Configure a tax type

Pre-condition: The current user must have ECM permission to create/edit adjustments.

Configuration is done in four areas of ECM:

- Financial - Create tax types (account level)

- Site - Enable tax types; establish tax rates (site level)

- Menus - Enable tax types per menu

- Menu items - Enable taxes for specific menu items; set any tax exemptions (account level)

FINANCIAL - CREATE TAX TYPES (ACCOUNT LEVEL)

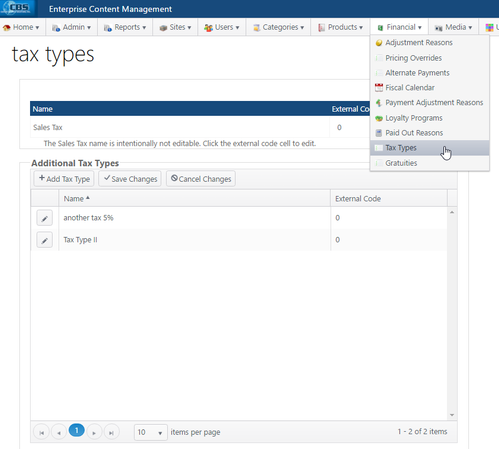

- In the primary navigation, go to Financial > Tax Types

- Note: Sales tax is the default tax type. The name cannot be edited.

Add Tax Type

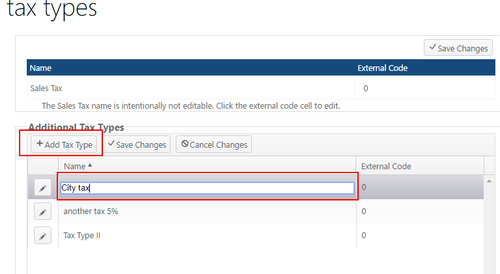

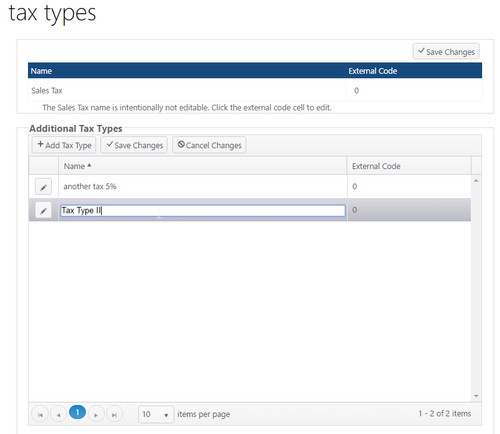

- Click Add Tax Type

- A new blank entry will be created. Enter the name of the new tax type

- Click Save Changes to save or Cancel Changes to cancel

- External code - leave blank unless needed for third-party integration

Edit Tax Type

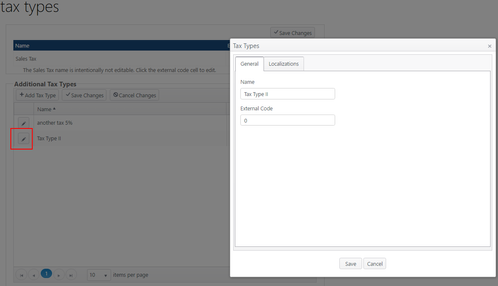

- Click the edit icon (pencil)

- Edit the name or external code in the pop-up window

- Alternate: Click in the name field or external code and field to edit

- Click Save Changes to save or Cancel Changes to cancel

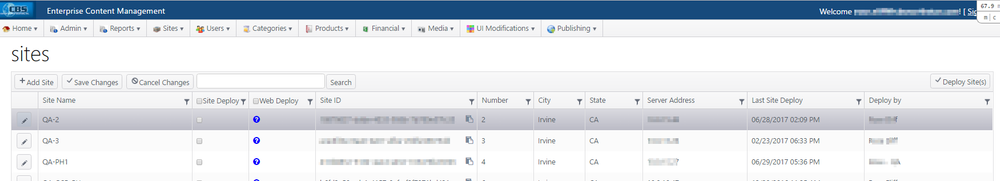

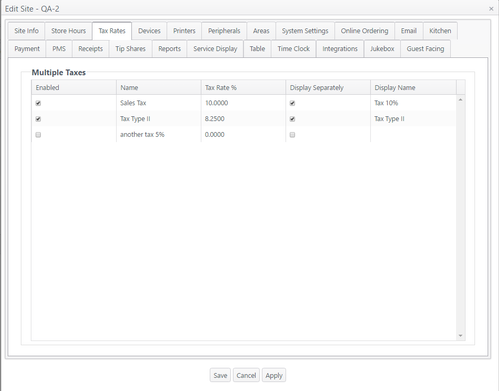

SITE - ENABLE TAX TYPES; ESTABLISH TAX RATES (SITE LEVEL)

- Select a site

- Select Tax Rates

- Checkmark the taxes to be enabled for the selected site

- Uncheck to disable a tax

- To enter or edit a tax rate %, click in the field and enter changes

- To enter or edit a display name, click in the field and enter changes

- Save, Cancel or Apply the changes (Apply will save the changes and remain on the page; Save will save the changes and close the page)

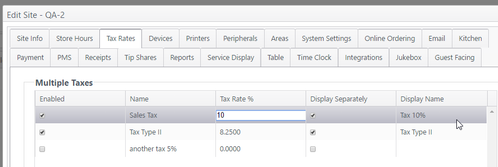

MENUS

- Go to Products > menus

- Select a menu (pencil icon)

- Select the taxes applicable to the selected menu and Save

MENU ITEMS - ENABLE TAXES FOR SPECIFIC MENU ITEMS (ACCOUNT LEVEL)

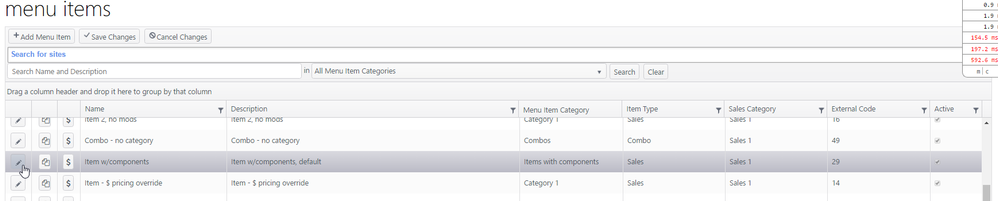

- Go to Products > Menu items

- Select a menu item (pencil icon)

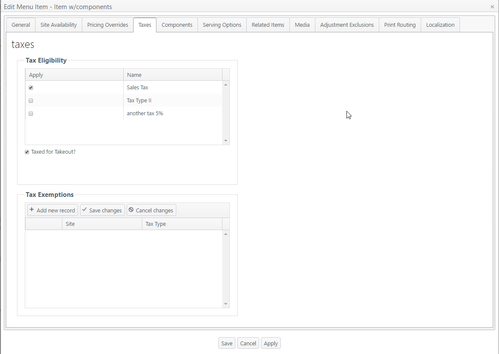

- Select Taxes tab

- Checkmark the taxes to be enabled for the selected menu item

- If a menu item is to be taxed for takeout, checkmark the box Taxed for Takeout?

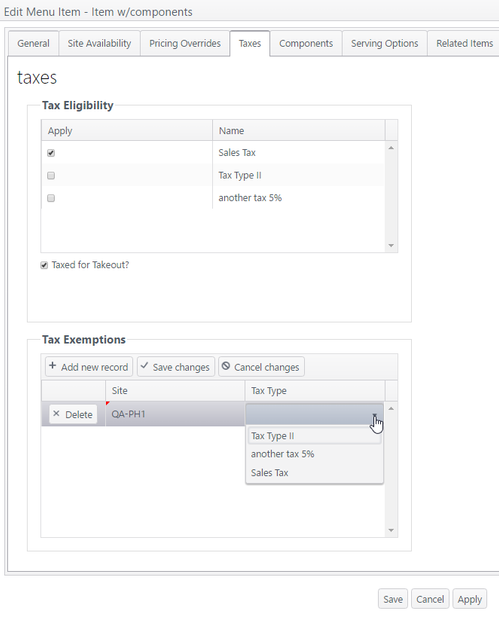

- Tax Exemptions

- Taxes that were enabled for a site can be exempted for a menu item at the site level

- Select a site from the drop-down menu

- Select a tax to be exempted for this menu item at the selected site

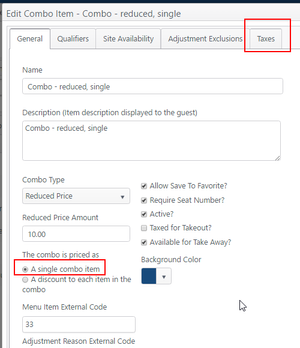

Combos

- Combo types that are configured to have a single combo price (prevailing single, reduced single) will display a Taxes tab, which will display the same taxes page as above.

- Combo types that are configured to have a discount to each item in the combo (prevailing discount, reduced discount) will not display a Taxes tab, as their taxes are inherited from the child menu items and applied to the parent.

- Save, Cancel or Apply the changes (Apply will save the changes and remain on the page; Save will save the changes and close the page)

Operation

- Order a taxable menu item

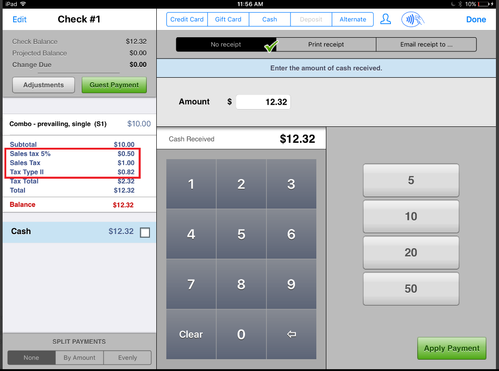

- The Payment screen will display the taxes that apply to the menu item

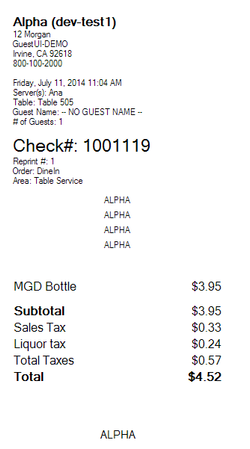

Receipt example:

Related articles

Multiple Tax Rates displayed on the On Screen Check

Example of multiple taxes displayed separately on a receipt