/

Configure multiple tax types and tax rates

Configure multiple tax types and tax rates

Summary

Tax types are created to apply taxes to taxable menu items. Each enabled tax type has a tax rate.

Example:

- Tax type = sales tax

- Tax rate = 8.75%

By default, each taxable menu item is automatically configured with a sales tax. Additional tax types can be configured for a site and applied to any menu item as needed, e.g., liquor tax, city tax, etc.

Each tax type is configured with a tax rate.

Configuration

Configure a tax type

Pre-condition: The current user must have ECM permission to create/edit adjustments.

Configuration is done in four areas of ECM:

- Financial - Create tax types (account level)

- Site - Enable tax types; establish tax rates (site level)

- Menus - Enable tax types per menu

- Menu items - Enable taxes for specific menu items; set any tax exemptions (account level)

FINANCIAL - CREATE TAX TYPES (ACCOUNT LEVEL)

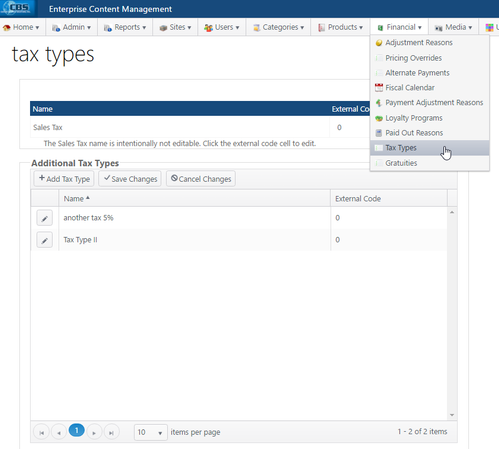

- In the primary navigation, go to Financial > Tax Types

- Note: Sales tax is the default tax type. The name cannot be edited.

Add Tax Type

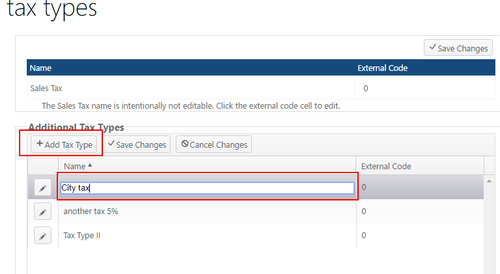

- Click Add Tax Type

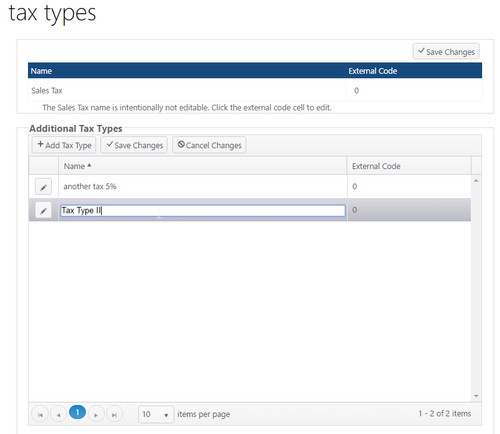

- A new blank entry will be created. Enter the name of the new tax type

- Click Save Changes to save or Cancel Changes to cancel

- External code - leave blank unless needed for third-party integration

Edit Tax Type

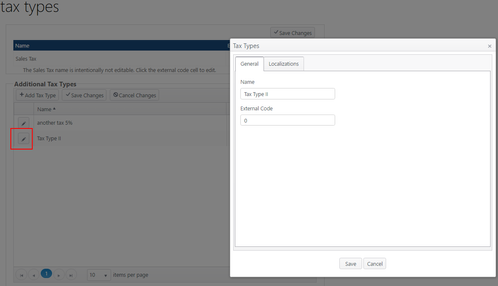

- Click the edit icon (pencil)

- Edit the name or external code in the pop-up window

- Alternate: Click in the name field or external code and field to edit

- Click Save Changes to save or Cancel Changes to cancel

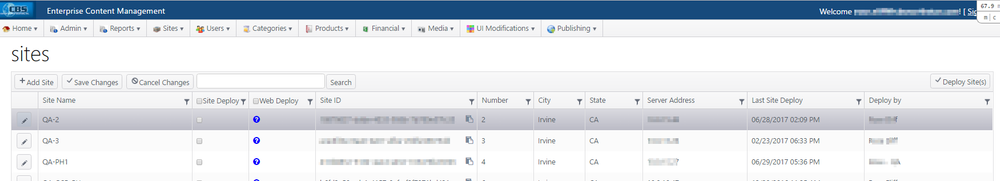

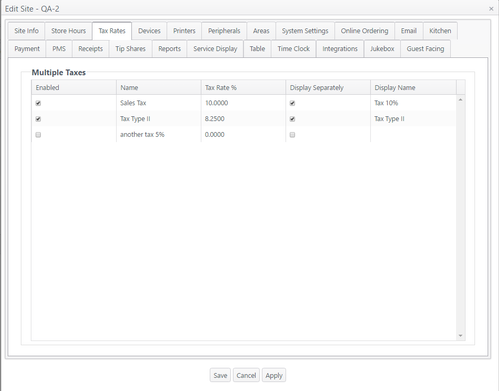

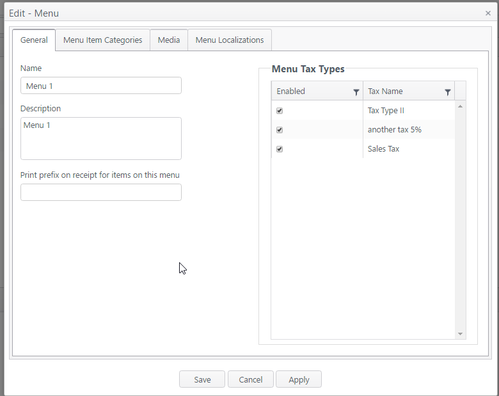

SITE - ENABLE TAX TYPES; ESTABLISH TAX RATES (SITE LEVEL)

- Select a site

- Select Tax Rates

- Checkmark the taxes to be enabled for the selected site

- Uncheck to disable a tax

- To enter or edit a tax rate %, click in the field and enter changes

- To enter or edit a display name, click in the field and enter changes

- Save, Cancel or Apply the changes (Apply will save the changes and remain on the page; Save will save the changes and close the page)

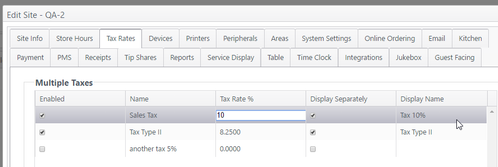

MENUS

- Go to Products > menus

- Select a menu (pencil icon)

- Select the taxes applicable to the selected menu and Save

MENU ITEMS - ENABLE TAXES FOR SPECIFIC MENU ITEMS (ACCOUNT LEVEL)

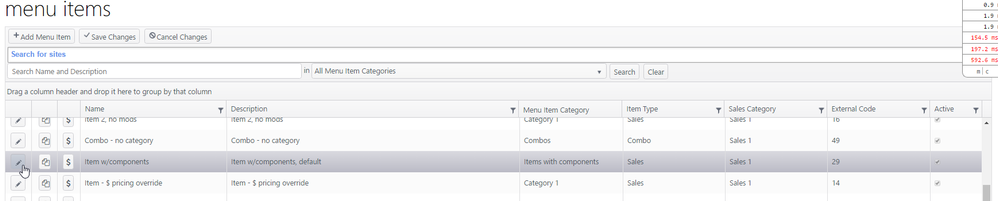

- Go to Products > Menu items

- Select a menu item (pencil icon)

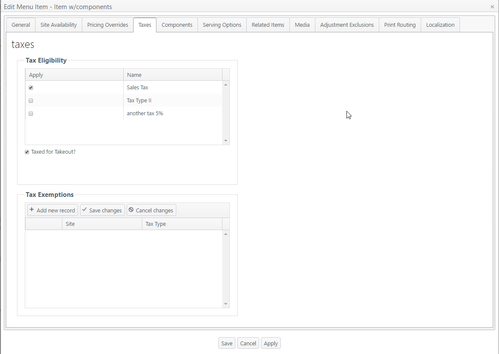

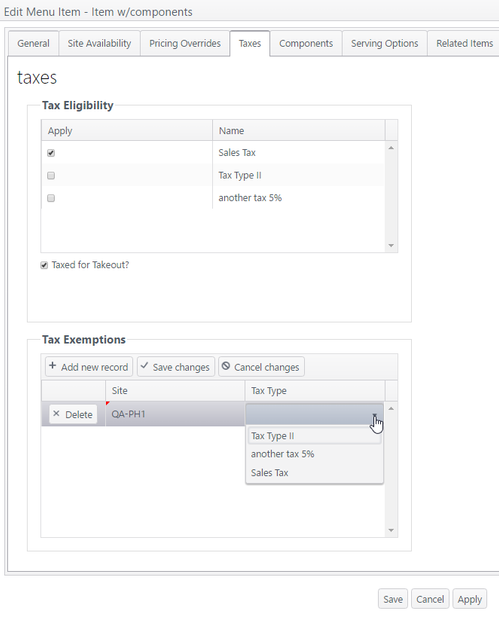

- Select Taxes tab

- Checkmark the taxes to be enabled for the selected menu item

- If a menu item is to be taxed for takeout, checkmark the box Taxed for Takeout?

- Tax Exemptions

- Taxes that were enabled for a site can be exempted for a menu item at the site level

- Select a site from the drop-down menu

- Select a tax to be exempted for this menu item at the selected site

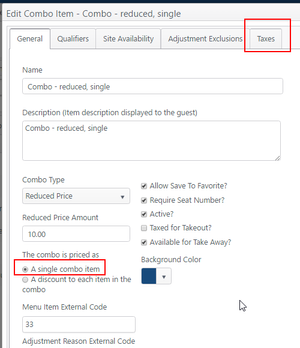

Combos

- Combo types that are configured to have a single combo price (prevailing single, reduced single) will display a Taxes tab, which will display the same taxes page as above.

- Combo types that are configured to have a discount to each item in the combo (prevailing discount, reduced discount) will not display a Taxes tab, as their taxes are inherited from the child menu items and applied to the parent.

- Save, Cancel or Apply the changes (Apply will save the changes and remain on the page; Save will save the changes and close the page)

Operation

- Order a taxable menu item

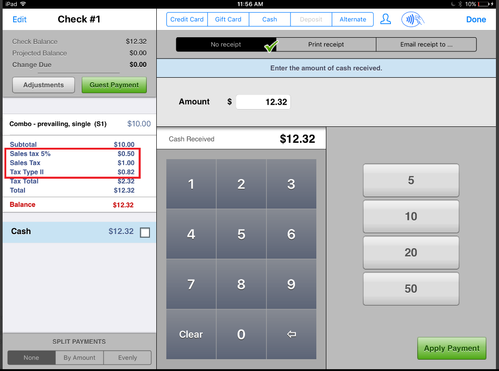

- The Payment screen will display the taxes that apply to the menu item

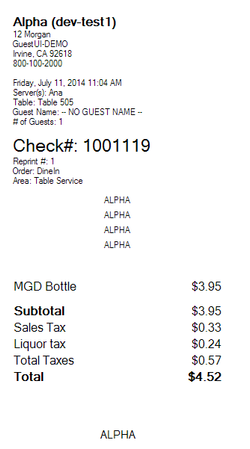

Receipt example:

Related articles

Multiple Tax Rates displayed on the On Screen Check

Example of multiple taxes displayed separately on a receipt

Related content

Tax Types

Tax Types

Read with this

ECM Release 2023-02-08 #284 and #285

ECM Release 2023-02-08 #284 and #285

More like this

ECM Release 2024-10-09 #353

ECM Release 2024-10-09 #353

More like this

Add/Edit a Menu - General

Add/Edit a Menu - General

More like this

ECM Release 2024-11-11 #355

ECM Release 2024-11-11 #355

More like this